Monmouth Series: Computer Use Agents and the Future of DeFi Interfaces

By Quincy Labs

Introduction: DeFi Has a UI Problem

DeFi today is a paradox.

On one hand, we’ve built the most composable financial system in history: DEXes, AMMs, lending markets, derivatives, structured products. On the other hand, the interfaces through which users interact with this composability remain siloed, clunky, and cognitively expensive.

Every new user faces the same labyrinth: a DEX to swap, an AMM to provide liquidity, a lending dashboard to borrow, another platform to hedge. Each requires different logins, different approvals, and constant vigilance over risks.

The missing layer is not another protocol. It’s an agent

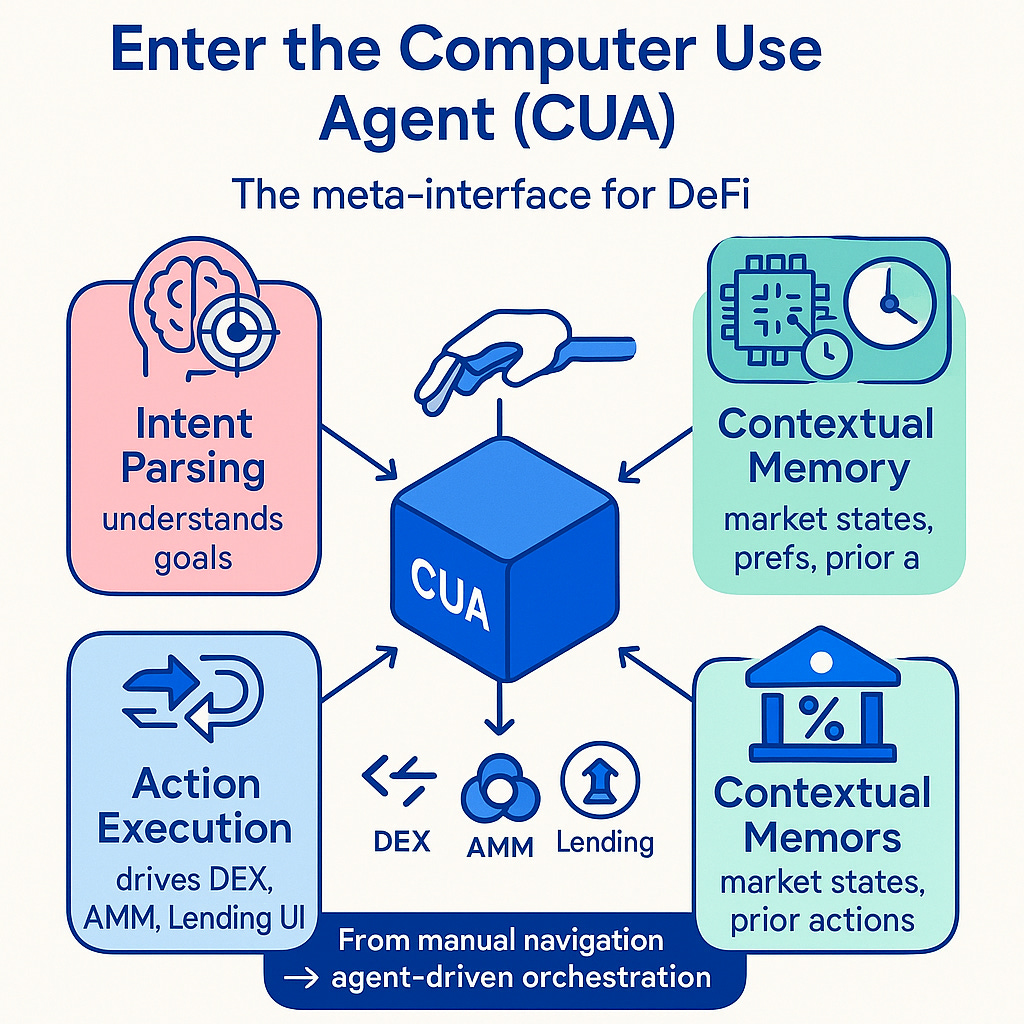

Enter the Computer Use Agent (CUA)

A Computer Use Agent (CUA) is not just an LLM clicking buttons. It’s a structured agentic system that combines:

Intent Parsing – Understanding high-level goals like “park idle ETH into yield, but hedge downside risk.”

Action Execution – Navigating existing interfaces (DEX dashboards, AMM pools, lending platforms) like a human user, but faster and without error.

Contextual Memory – Retaining knowledge of market states, user preferences, and prior actions

CUAs mark the shift from manual DeFi navigation to agent-driven orchestration.

They are not “new apps.” They are the meta-interface—the entity that makes fragmented protocols usable as a single fabric.

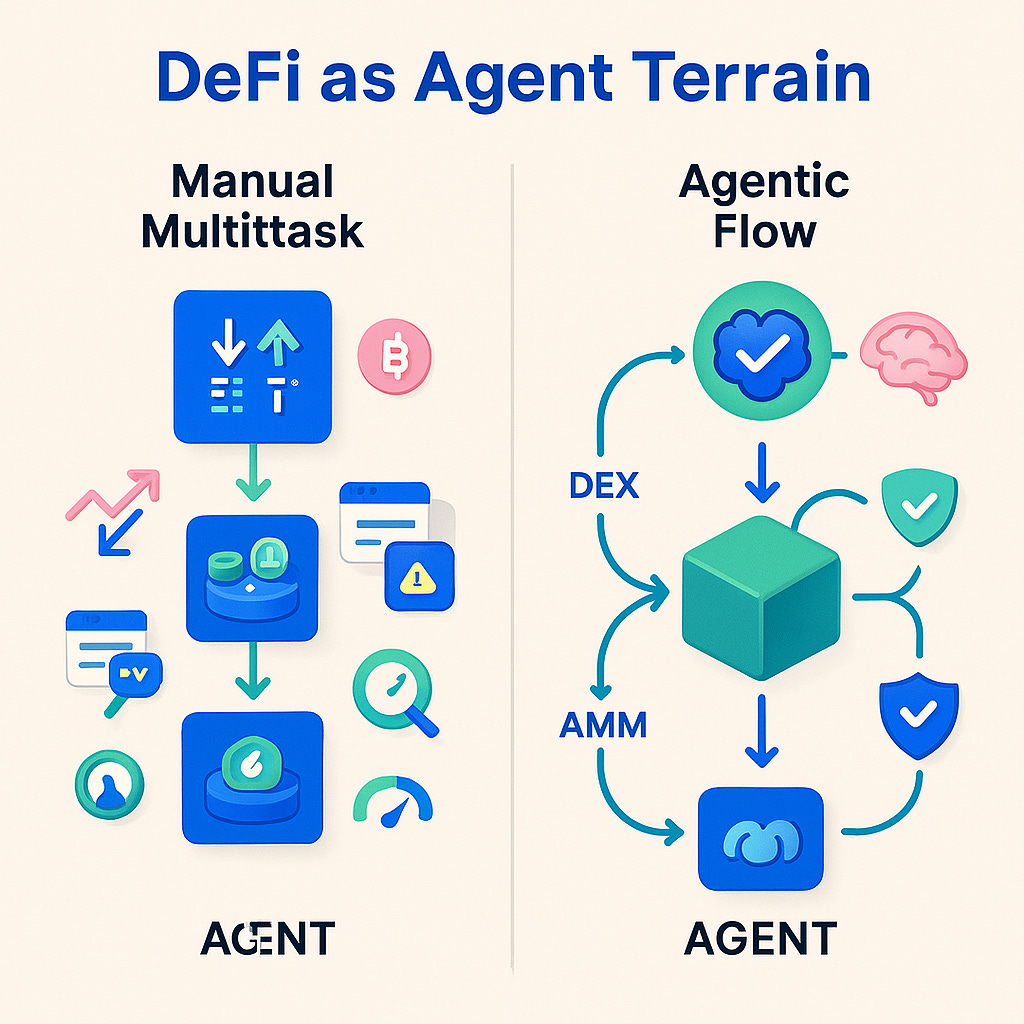

DeFi as Agent Terrain

When you strip DeFi to its bones, you get three primitives:

DEX – Markets for swapping assets.

AMM – Pools for providing and routing liquidity.

Lending – Markets for leverage and collateral.

Everything else is a derivative or recombination of these three.

The challenge: users must string them together manually. Want delta-neutral ETH yield? You need to:

Swap ETH → stETH via a DEX.

Deposit into an AMM pool for liquidity.

Hedge with a lending protocol to short perps.

Monitor collateral ratios and adjust daily.

That’s a multi-tab, multi-transaction nightmare

A CUA collapses that workflow into one intent:

“Turn my ETH into delta-neutral yield with minimal risk.”

The agent executes across all three primitives, hedges funding spreads, and continuously monitors the position.

DeFi stops being an exercise in multitasking—and becomes agentic finance.

Why CUAs Transform DeFi

The Wallet Evolves

Wallets cease being static key stores.

They become agent shells, embedding memory, preferences, and risk limits.

Protocols Become Services

AMMs, DEXes, and lending markets stop being dashboards.

They are consumed invisibly as services called by CUAs.

Liquidity Flows Become Autonomous

Agents arbitrage, hedge, and cooperate with each other in real-time.

Yield strategies emerge not from static contracts but from agent interactions.

DeFi isn’t just composable code anymore—it’s composable cognition.

Monmouth’s Lens: AI-Native Infrastructure

At Monmouth, we see CUAs as the natural front-end for AI-native DeFi.

They sit where user intent meets agent orchestration. They’re the key to bridging humans, protocols, and AI.

Here’s how it fits into our roadmap:

Execution Extensions (ExEx): Agents don’t just transact; they execute continuous workflows at the client level.

Memory × RAG: Agents anchor their decisions in persistent memory, verified on-chain via Proof-of-RAG.

On-Chain RL Environments: Our beta nets are live training grounds where CUAs evolve under real economic feedback.

This isn’t a speculative layer. It’s the operating system for DeFi agents

The Bigger Picture: Interfaces as Power

The history of computing shows a pattern:

GUIs beat command lines.

Browsers beat desktop apps.

Mobile UIs beat clunky web forms.

Each time, control of the interface redefined control of the ecosystem.

DeFi is about to experience the same shift. CUAs are the new browser. Protocols are the new web servers. And Monmouth is positioning itself to be the memory-native operating layer where agents coordinate and consensus itself becomes cognitive.

Closing Thought

DeFi doesn’t need more dashboards. It needs fewer clicks, fewer risks, and fewer blind spots.

Computer Use Agents give us that. They let us collapse intent into execution, turning DEXes, AMMs, and lending markets into invisible services.

The future isn’t another yield farm. It’s an agent-native UI paradigm—and we’re building it.

Next in the Monmouth Series

Proof-of-RAG and Memory Consensus

Agentic Wallets as Persistent Identity

RL Testnets: Training Finance in the Wild